owe state taxes from unemployment

Ad No Money To Pay IRS Back Tax. Unemployment Phone Number In New Jersey.

How To Get A Refund For Taxes On Unemployment Benefits Solid State

In every other state unemployment benefits are treated as regular income.

. To help offset your future tax liability you. Check all of the data you. You have to pay federal income taxes on your unemployment benefits as well as any applicable local and state income taxes.

To stay on top of this issue you should adhere to your Form 1099-G which you will receive from the IRS in the mail that will tell you how much you must report in. The IRS considers unemployment benefits taxable income When filing this spring your unemployment checks from 2021 will be counted as income taxed at your. Oregon Unemployment Claim System Online.

Report unemployment income to the IRS. New Jersey has a marginal income tax of 1075 percent for individuals making more than. You may have to pay estimated quarterly payments or pay taxes when you file your annual tax return if you dont.

Ad two states only tax a portion of. Although the state of New Jersey does not tax Unemployment Insurance benefits they are subject to federal income taxes. You can do the same thing with unemployment income.

Yes you can owe taxes on unemployment payments because unemployment is taxable income. Bank Of America Unemployment Cards. Ad No Money To Pay IRS Back Tax.

Montana New Jersey Alabama Pennsylvania and Virginia as well as California exempt unemployment benefits from income taxes. Any money that you receive is subject to federal or state tax or both. Ad File unemployment tax return.

1 day agoTyreek Hill says he spurned Jets for Dolphins over state taxes By. Ad two states only tax a portion of unemployment benefits Indiana and Wisconsin. People whose adjusted gross income was less than 150000 can exclude up to 10200 of unemployment benefits from taxes in 2020.

Over 50 Million Returns Filed 48 Star Rating Claim all the credits and deductions. 100s of Top Rated Local Professionals Waiting to Help You Today. When she filed taxes for 2020 Freed discovered she owed New York State 1200 for income taxes on unemployment benefits.

The usual reason for owing state tax is that you did not have enough withheld from your paychecks---or perhaps from your unemployment. Some states may allow you to withhold 5 for state taxes. I owe you boy.

Similar to how you receive a W-2 or 1099-MISC. However State Budget Director. To do this you have to complete a Voluntary Withholding Request or Form W-4V with your state unemployment.

Unemployment compensation is considered taxable income by the IRS and most states thus you are required to report all unemployment income as reported on Form 1099-G. The maximum weekly benefit at 504.

2020 Unemployment Tax Break H R Block

Unemployment Benefits Tax Issues Uchelp Org

What Is A 1099 G Form And What Do I Do With It

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Jobless Workers May Face A Surprise Tax Bill Or Smaller Refund

How Will Unemployment Benefits Impact Your 2020 Taxes Legalzoom

Unemployment Benefits Are Taxable Here S What To Know Nextadvisor With Time

Unemployment Benefits Will Affect 2020 Tax Filings

Quickbooks Learn Support Online Qbo Support My State Unemployment Taxes Due For 2nd Quarter Doesn T Match With What The State Says I Owe Qb Says I Owe More

Ohio Income Taxes Unemployment Benefits From 2020 Won T Be Taxed For Most Filers

Connecticut Businesses Could Owe Up To 1 Billion In Unemployment Taxes They Want The State To Cover It With Federal Relief Funds

Last Year S Unemployment Benefits Could Cost Americans 50 Billion At Tax Time Cbs News

California S Unemployment Debt Likely To Increase Costs On Businesses For Years California Thecentersquare Com

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

What Are Employer Taxes And Employee Taxes Gusto

Federal Covid Relief Includes Tax Break On Unemployment But Nc Sc Law Doesn T Comply Wcnc Com

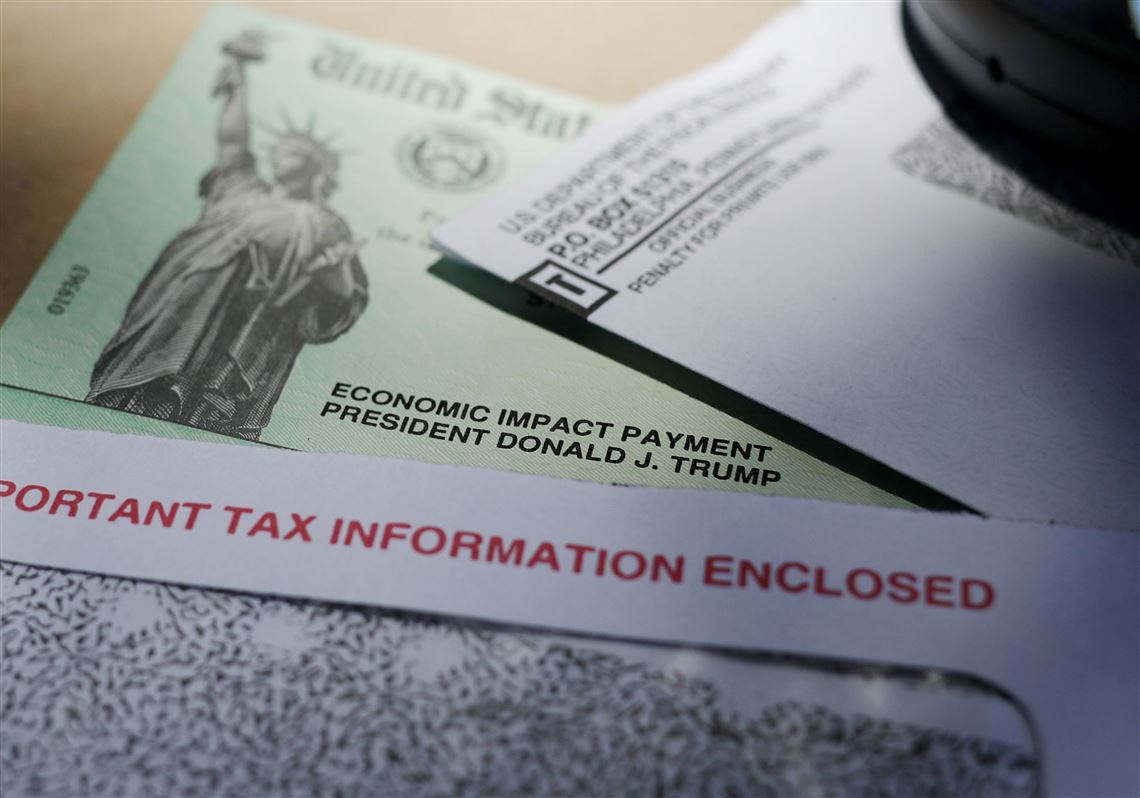

For Those Collecting Unemployment Benefits Tax Day May Come With A Surprise Expense They Can T Cover Pittsburgh Post Gazette